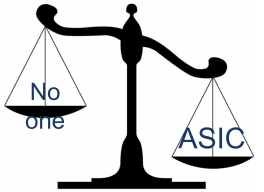

'Landmark' Payday Lending Fine Marks Pyrrhic Victory for Regulator

By Nathan Lynch, Thomson Reuters

SYDNEY: 20 February 2015 - The Australian Securities and Investments Commission has won something of a Pyrrhic victory in securing a record A$18.9 million penalty against two non-compliant payday lenders, with the defendants being highly unlikely to pay their fines. The combined penalty against two Canadian-linked firms, the Cash Store and loan funder Assistive Finance Australia, was described by ASIC as a "landmark" victory for the regulator. Peter Kell, deputy chairman of ASIC, said the Federal Court's decision constituted "essential reading" for all credit licensees who wanted to understand their responsible lending obligations.

"The significant size of the penalty imposed shows ASIC and the court take these obligations very seriously, as must all lenders, no matter how small the loan is," Kell said in the wake of the record penalty for breaches of the national credit laws. The regulator is positioning the decision as a critical precedent in building case law around the "responsible lending" obligations under Chapter 3 of the National Consumer Credit Protection Act 2009 (NCCP Act).

On face value, the judgment in ASIC v The Cash Store (in liquidation) [2014] FCA 926 is undoubtedly a significant win for ASIC. The regulator managed to establish, among other things, that the defendants failed to make "reasonable enquiries" about their customers' objectives and requirements. In a sample of contracts considered by the court it was also established that the credit providers failed to take reasonable steps to verify the customers' financial situation.

These matters are fundamental to the NCCP Act, and credit licensees can undoubtedly benefit from some case law surrounding what constitutes "reasonable enquiries" and "reasonable steps."

Justice Davies noted that assessing whether there was a real chance of a person being able to comply with one's financial obligations under a credit contract requires, at the very least, a sufficient understanding of the person's income and expenditure.

"It is axiomatic that reasonable enquiries about a customer's financial situation must include enquiries about the customer's current income and living expenses. The extent to which further information and additional enquiries may be needed will be a matter of degree in each particular case," the judgment noted.

Uncontested case

While the decision is useful in helping to flesh out the case law around the NCCP Act, it has been undermined by the fact that the matter was uncontested by both defendants. Lawyers specialising in consumer credit also told Accelus Regulatory Intelligence that it would be difficult to apply the decision to other lenders that lend larger sums of money. Compliance resources at a large-scale lender are completely different to those of a payday lender, which may only stand to make hundreds of dollars on an individual credit contract, they said.

In addition, the fact that the matter was not contested throws into doubt its validity as a precedent, as a contested case may have led to a better outcome for the defendants. Lawyers also said the A$18.95 million penalty may have been smaller, or reduced on appeal, had the defendants chosen to challenge ASIC's action and appear in court.

Jon Denovan, partner at Gadens in Sydney, said the "general industry opinion" was that the decision would have been different and any penalties would have been reduced had the matter been defended. As such, it was difficult to determine the extent to which the decision would be applicable to other similar cases.

"As the company [Cash Store] is in voluntary liquidation or may by now be liquidated, the penalty order seems to be a pointless exercise. It has the industry confused as to why ASIC spent the money on seeking penalty orders," Denovan said.

David Jacobson, principal at Bright Law, echoed these sentiments and said it was difficult to assess the benefit that ASIC had secured in pursuing the action.

"The first observation has to be that Cash Store is in liquidation and unlikely to pay its penalty. Secondly, neither Cash Store nor the other defendant Assistive Finance Australia actually defended ASIC's case. Having said that, Judge Davies did test ASIC's evidence and in some cases did not agree with it," Jacobson said.

Despite these concerns, consumer advocacy groups have applauded ASIC's efforts to hold the sector accountable and to set a benchmark for good conduct — even though the defendants appear to have left the Australian market. Gerard Brody, chief executive of the Consumer Action Law Centre, said the decision would send a strong message to all payday lenders.

"If they’re going to breach credit laws and take advantage of low income and vulnerable Australians, ASIC will take them to task," Brody said. "The behaviour of these lenders was atrocious and warranted such a substantial fine. Companies that prey on vulnerable Australians should feel the full weight of the law."

Setting standards

Jacobson agreed that ASIC has been able to set some high standards for responsible lending with this case, which it will be keen to enforce generally — not just against payday lenders.

"The case is also notable for the findings on mis-selling of consumer credit insurance and ASIC will also pursue this area," Jacobson said.

Denovan said the case was further evidence that ASIC had increased its surveillance work in the area of responsible lending. In particular, he said the regulator wanted to see evidence that compliance processes are in place to ensure that credit contracts meet the borrower's "requirements and objectives" and that the lender makes appropriate enquiries into what constitutes "household living expenses" for individual borrowers.

In terms of sending a shot across the bow of credit providers, however, the industry is questioning the extent to which the regulator is willing to take on challenging cases against genuine defendants. One industry participant noted that ASIC appeared more than willing to take on smaller defendants with limited defence resources, yet was less eager to get involved in expensive, drawn-out litigation.

Others have questioned whether the consumer credit regime is suitable for short-term, small-amount lenders who simply do not earn enough profit on each loan to justify the onerous compliance obligations associated with the NCCP.

As an example, if a payday lender provided $1,000 to see a consumer through a short-term cashflow problem, the lender is only able to charge a 20 percent establishment fee and 4 percent interest per month. If the loan is repaid within the first month the return on that credit contract would be 24 percent, or $240.

The challenge for payday lenders is that they often struggle to justify having robust compliance controls in place for credit contracts of this size.

Short-term contracts

Denovan said he had some sympathy with this view and questioned how the government and regulator could expect short-term, small-amount lenders to comply with these obligations.

"ASIC — and for that matter the law — wants the same due diligence for a $500 short-term loan as it does for a $5 million loan. Perhaps even more for the small loan because the borrowers are less sophisticated. While I appreciate the need for consumer protection, the issue is becoming whether these people should be prohibited by law from borrowing — a result which I think is unjust and unworkable," Denovan said.

The result of this regulatory regime is that many small-scale lenders have gone out of business and more are likely to follow. The Cash Store was put into voluntary administration because of trading losses well before this court case was decided. Denovan said its financial troubles did not stem from the ASIC prosecution but rather from the small returns on small-amount lending and the high cost of doing business.

As a consumer advocate, Brody said he did not believe that the compliance obligations under the NCCP Act were "unrealistic" for smaller lenders. "If you are selling a high-cost product that can cause significant detriment to vulnerable consumers, then additional compliance obligations are warranted. If you operate in a licensed and highly regulated industry and cannot understand your obligations, or are unwilling to comply with them, then you shouldn't be operating in the industry. Sell DVDs or something instead," he said.

In the case of payday loans, Brody said the responsible lending obligations were the minimum that is necessary to ensure that loans are not lent where they will cause more harm than good.

"The problem is systemic non-compliance with this obligation, which should be of concern not only to regulators but also investors in payday lending businesses," Brody said.

Kell said ASIC believed this was an area where consumers had been suffering from unsuitable credit contracts and the regulator had an obligation to enforce the law and to protect consumers.

"ASIC is all about making sure people taking out loans have trust and confidence in the consumer credit sector and that those offering credit obey the law. And those laws have responsible lending provisions that aim to protect consumers of credit services from taking out loans they can't afford and to stop businesses from taking unfair advantage of vulnerable people," Kell said.

"That is why we brought this case and this is what the Federal Court has recognised with this penalty," Kell added.

Unresolved concerns

Among the legal community, questions surrounding the relevance of the case and the suitability of the NCCP Act in this area are still unresolved. Denovan said that if this was not addressed it could lead to the closure of lenders which, in turn, could drive desperate borrowers into the hands of unlicensed and illegal lenders.

"The simple fact is that for the very small return lenders are allowed to derive on small-amount short-term loans it is simply commercially impossible to jump through all the hoops ASIC is presenting based on responsible lending. If this doesn't stop, the industry could be shut down – but consumers will still borrow money and will be forced to deal with criminals and unlicensed lenders. The demand for these loans is clear and won't go away," Denovan said.

In the case of the Cash Store and AFA, it is highly unlikely that the penalties will be paid. The Cash Store is a wholly-owned subsidiary of a Canadian company, The Cash Store Australia Holdings, which is listed on the Toronto Stock Exchange. AFA is also a wholly-owned subsidiary of a Canadian company, Assistive Financial Corporation.

Until September 2013, Cash Store was operating as a payday lender with all of its loans being financed by AFA. Cash Store had around 80 stores across Australia and wrote an estimated 10,000 loans per month. The typical loan was for less than $2,200 and was for a short period — usually two weeks or less. According to ASIC the typical fees, charges and interest on these loans amounted to around 45 percent of the loan amount.

The Cash Store was also mis-selling consumer credit insurance (CCI) policies known as the "Cash Store Australian Payment Protection Plan". In many cases, the lender's customers were on Centrelink benefits and had very little ability to repay without suffering hardship. They also stood to gain little from CCI policies, which protected clients in the event of a job loss.

According to the judgment Cash Store charged its customers a premium of 3.38 percent for the CCI cover. "TCS collected over $2 million from customers in insurance premiums during the period when it sold CCI and paid out claims worth about $25,000," the judge noted. "[T]he average ratio of claims to premiums for the TCS policy was 1.1 percent compared to an industry average of 20.7 percent. The value of the CCI policy sold by TCS as measured by the average return to the customer was 1/19th of the CCI industry average."

Meeting obligations

ASIC said in a statement following the judgment that the NCCP Act requires credit licensees to meet responsible lending conduct obligations. It said these obligations were designed and implemented to protect all consumers — but particularly those who may be vulnerable to exploitation.

"The key responsible lending obligation is that credit licensees or providers must not suggest, assist with or provide a credit product that is unsuitable for a consumer," ASIC said.

Before suggesting, assisting with, or providing a new credit contract or lease to a consumer, the credit licensee or credit provider must:

- make reasonable enquiries of the consumer about their requirements and objectives in relation to the credit contract;

- take reasonable steps to verify the consumer's financial situation;

- based upon these enquiries, assess whether the credit product is unsuitable for the consumer and only proceed if the credit product is not unsuitable; and

- give the consumer a copy of the assessment if requested.

In addition to these obligations, the licensee must provide the consumer with a credit guide setting out important information about the licensee and the loan product.

In the case of Cash Store, it was found to have breached seven separate provisions of the NCCP Act, while AFA breached six. In addition, Cash Store was held liable for the breaches of AFA for being "knowingly concerned in the breaches by AFA", pursuant to section 169 of the NCCP Act.

Despite the detailed findings in ASIC v The Cash Store, lawyers have observed that the case does little to help resolve the question of what constitutes "reasonable enquiries and verifications" on any specific transaction.

In the meantime, ASIC has trumpeted the fact that the defendants have been ordered to pay ASIC's costs for the proceeding. This is highly unlikely given the fact that one defendant is in liquidation and the other has fled the country.

More than anything, this statement perhaps underscores ASIC's failure to grasp the fact that Cash Store and AFA are highly unlikely to return to operating in a market where they can see little commercial benefit after complying with the regulatory regime.

The Cash Store's Australian assets were bought by Money3, a competitor, for a nominal sum in 2013. Money3 has since tried to move away from short-term credit contracts to the more lucrative personal loan market, where compliance costs can be amortized over a longer loan term and larger amounts.

Brody, meanwhile, said the suggestion that payday loans are not profitable due to the regulatory burden was "laughable". Lenders simply need to become more efficient about the way that they deliver their products — perhaps relying less on high-cost bricks and mortar outlets.

"Since national consumer protections were implemented we've seen a proliferation of online lenders entering the market. One high-profile lender, Nimble, increased revenue in their second year of operation by 46 percent to $12.7 million. Clearly there is money to be made," he said.

Brody also noted that Money3's share price has continued to rise since the acquisition of Cash Store's assets, and Cash Converters' latest annual report included an increase in personal loan interest of $29.6 million.

Regardless of the state of the broader industry, it seems that Justice Davies' record penalties against Cash Store and AFA will be a bittersweet victory for the regulator.

The record fine of $18.9 million is at face value a major win for ASIC but, on closer inspection, it will have little impact on either of the two defendants.

In addition, ASIC's legal costs in this case are very likely to be borne by the regulator — in spite of the court's order.

ASIC is undoubtedly hoping that the deterrent effect will go beyond the specifics of this case. The risk to the regulator, however, is that this will be perceived as further evidence that ASIC is prepared to "go hard" on easy targets — or indeed absent targets — but prefers to accept enforceable undertakings in the more complex cases involving deep-pocketed defendants.

Nathan Lynch is the head regulatory analyst, Australia and New Zealand, for Thomson Reuters.

This article was first published by the Regulatory Intelligence service of Thomson Reuters Accelus. Regulatory Intelligence (http://accelus.thomsonreuters.com) provides a single source for regulatory news, analysis, rules and developments, with global coverage of more than 230 regulators and exchanges.

Add new comment